Us bank home equity line of credit calculator

Money will be advanced to you up to your credit limit Ameris Bank will pay your closing costsup to 2000 1. HSBC checking account which must be.

How To Use Home Equity Line Of Credit U S Bank

Put your home equity to work for you with a Home Equity Credit Line from Nevada State Bank.

. How A HELOC works. Whether youre funding home renovations sending a child to college or helping pay for a wedding well work alongside you to find a lending option that works best. Why Use Your Home Equity.

You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only. APR The APR is the annual cost of the loan and includes fees such as mortgage insurance most closing costs discount points and loan origination fees indicating the total cost of the loan. Learn more about HELOCs.

CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans such as credit cards. Compare 0 Clear All You can compare maximum three products at a time.

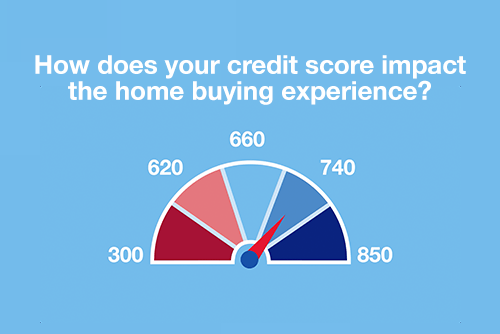

The more your home is worth the larger the line of credit. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. For Texas primary residences we will lend up to 80 of the total equity in your home and your line of credit amount cannot exceed 80 of the homes value.

After investing so much time and money in your home its time to take advantage of its equity. You can utilize all or a portion of the total credit limit as you need it and only pay interest on the amount you use. To Apply Now or Schedule an Appointment.

Third Federal Savings. During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. Annual Fee and the reimbursement of any closing costs paid on borrower behalf by PNC Bank if customer closes the line of credit.

Our Home Improvement Calculator can create a personalized cost estimate for your project plan. A home equity line of credit or HELOC is a type of home equity loan that works like a credit card. For line amounts greater than 500000 maximum combined loan-to-value ratios are lower and certain restrictions apply.

A Home Equity Line of Credit from FNB is a credit line that helps you access the equity in your home to provide a reusable source of financing to help meet your financial objectives. Use our free mortgage calculator to estimate your monthly mortgage payments. Put Your Home Equity to Work.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. Mortgage rates valid as of 31 Aug 2022 0919 am.

Account for interest rates and break down payments in an easy to use amortization schedule. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. The loan officers we worked with at Chase Bank were helpful and able to explain how each modification to their standard line of credit products would impact the structure of the product.

Obtaining the best rate also requires the following criteria to be met. A home equity line of credit is the most flexible type of home financing available. 1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and.

Use this calculator to determine the home equity line of credit amount you may qualify to receive. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. Youre given a line of credit thats available for a set time frame usually up to 10 years.

You can tap into this equity in a few ways and finance other goals or purchases you may have. The APR will vary with Prime Rate the index as published in the Wall Street Journal. As with most home equity lines of credit Wells Fargo will charge interest during the draw period and you only have to pay on what you borrow.

When you have unexpected expenses or projects to finance consider how a Home Equity Line of Credit HELOC from Atlantic Union Bank can provide the solution and peace of mind knowing youre prepared for anything life throws your way. Free calculators for your every need. Established in 1971 and with a presence in 15 states Regions offers a full lineup of personal banking services including checking and savings accounts credit cards mortgages student.

Affordable annual fee. The Choice Home Equity Line of Credit from PNC is a flexible home equity loan option that allows you to chose. An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months.

The maximum line amount or credit limit on your HELOC is based on how much equity you have in your home your creditworthiness your debt-to-income ratio and your combined loan to value ratio or CLTV. Credit line may be reduced or additional extensions of credit limited if certain circumstances occur. As you pay down your mortgage andor your home appreciates in value your equity grows.

To qualify for discounted rates on a Home Equity Line of Choice payment must be made via automatic payment from a US. Using the equity youve built in your home we can provide you with a revolving line of credit to help you finance important purchases or consolidate high-interest debt. Home equity loan calculator.

One of the nice things. Home equity lender reviews. This is impressive given how complicated these products can be and it shows why Chase is the largest home equity line of credit provider in the country.

Find out about home equity rate and apply online today. A home equity line of credit HELOC provides the flexibility to use your funds over time. Home equity is the current value of your home minus your outstanding mortgage balance.

The line of credit is based on a percentage of the value of your home. Combined with their long history and branches in 41 states this makes Wells Fargo one of the best places to go if you are interested in obtaining a home equity line of credit. Home equity line of credit HELOC.

Of course the final line of credit you receive will take into account any outstanding mortgages you might have. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. A Home Equity Line of Credit is a revolving line of credit.

This means that as you pay off the credit advanced to you you can use the credit line again throughout the term of your agreement.

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Loans Home Loans U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Use Home Equity Line Of Credit U S Bank

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Home Loans U S Bank

How To Use Home Equity Line Of Credit U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Qualification Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator

Home Equity Second Mortgage Vs Home Equity Loan U S Bank

Home Equity Loan Calculator Which Home Equity Loan Is Right For You

Mortgage Payoff Calculator With Line Of Credit

How To Use Home Equity Line Of Credit U S Bank